BRAVO! Top Slicing On Offshore Bonds

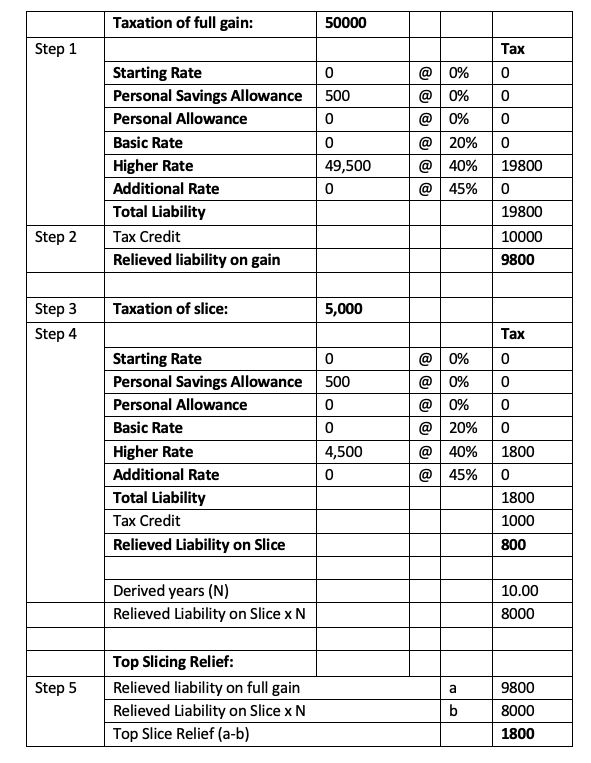

Top slicing relief can reduce higher rate tax on a chargeable event gain by allowing the bondholder to spread the investment gains over the number of. Bridgits taxable income including the chargeable event gain is.

Changes To Top Slicing Relief On Life Insurance Policy Gains Sail Solutions

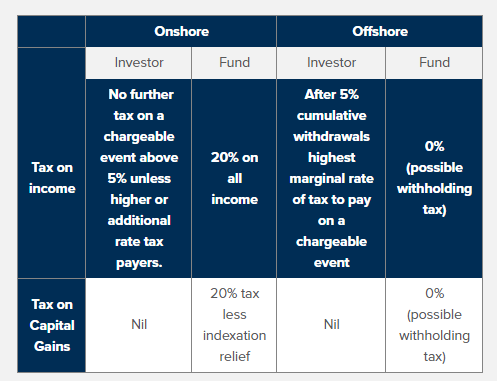

Top-slicing on offshore bonds is a well-known benefit and can help a client apportion any gain over the life of their policy thereby reducing the.

Top slicing on offshore bonds. Calculate top slicing relief due Top slicing relief is the difference between the total liability and the total relieved liability. Personal Portfolio Bonds PPB. Do not pay higher rate tax on your other income excluding the.

The key thing to understand is that the shorthand method of top slicing many advisers will have relied upon to work out the additional tax on the bond. Within the 202021 tax year the individual has also made a 30000 gain on an onshore investment bond over 5 complete years providing them with. The slice is then.

However if the chargeable event is a second or. Top slicing relief can only be claimed on bond gains where some of the gain is subject to tax at higher or additional rate. Onshore bonds can benefit from top slicing but it is only available going back to the date of the last chargeable event - and not back to the start of the bond.

Get direct market access to the whole investment bond market with no hidden fees. Ad Secure high-yielding corporate bonds with higher returns than term deposits. Assignments the top-slice is worked out using the number of complete years since the policy started.

Effective from 6 April 2016 a new personal savings allowance was introduced. There is no distinction between UK and offshore bond gains. A Top Slicing Relief TSR calculation should be embraced rather than feared.

Top slicing relief is available for the higher rate and additional rate calculations. Without it clients could be. What is top-slicing relief.

Example of top slicing relief for an onshore bond with additional rate tax due. It is after all a good thing. Making pension contributions can.

Top slicing can be applied where the whole gain pushes a taxpayer into a higher rate of tax than they would have otherwise paid were it not. Top-slicing works by taking the gain and dividing it by the complete years the bond has been in place which creates a slice. Top slicing relief Step 4 Tax before top slicing relief onshore gains Personal.

Previously it was generally. This is a relief that is available when you. Although that might seem odd any confusion is cleared up by the following section.

Top-Slice relief 5000 - 0 5000. Key Points Where a chargeable gain falls into two tax bands it is possible to top slice the gain.

How Top Slicing Has Been Changed For Ever And What To Do Now Professional Paraplanner

Changes To Top Slicing Relief On Life Insurance Policy Gains Sail Solutions

How To Apply Top Slicing Relief To Uk And Offshore Bonds International Adviser

Ril Ongc Inks Mou To Share Eastern Offshore Infra Facilities Mumbai Reliance Industries Ltd Ril Has Signed A Memo Business Investors Things To Sell Reliance

Sean Connery Gunbarrel Sequence Google Search James Bond Movies James Bond Sean Connery James Bond

Changes To Top Slicing Relief On Life Insurance Policy Gains Sail Solutions

Changes To Top Slicing Relief On Life Insurance Policy Gains Sail Solutions

Exam Traps Tax Stumbling Blocks Top Slicing Rm Advance